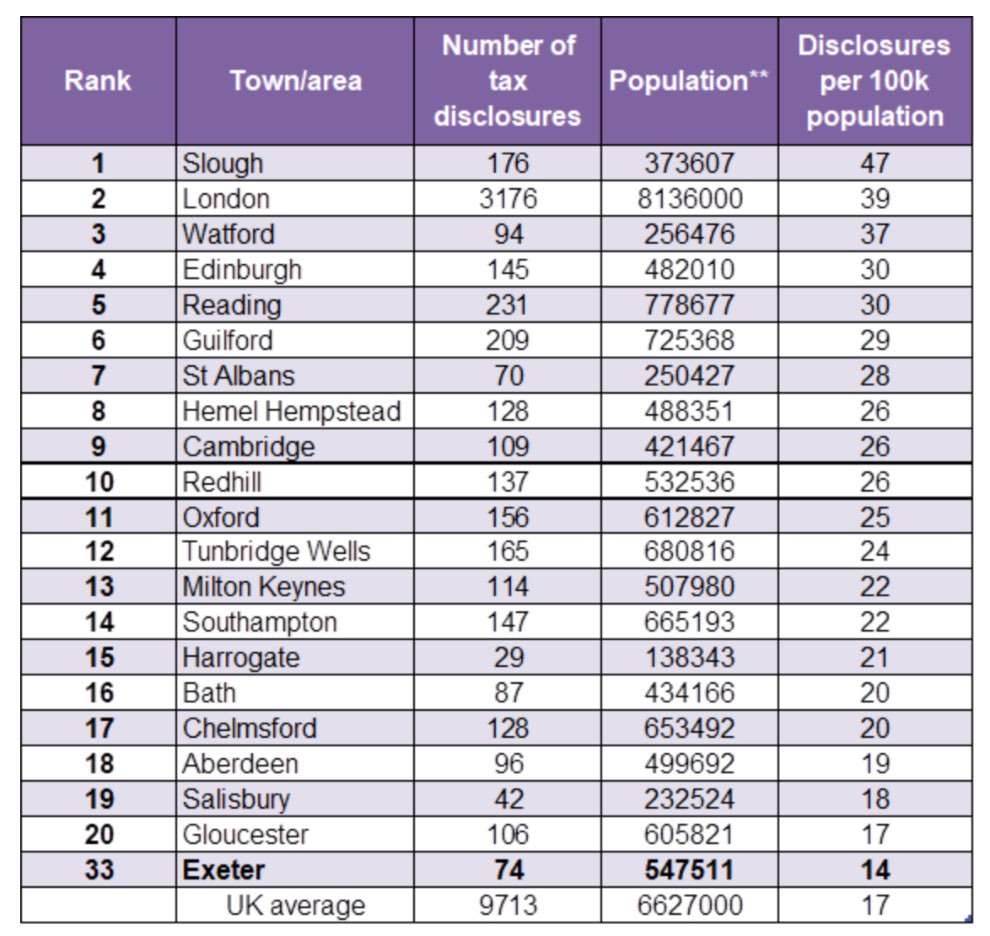

Exeter comes 33rd of all UK areas for admitting tax avoidance

Exeter comes in at number 33 in list of over 100 UK areas for admitting underpaid tax from offshore interests last year*, reveals new research from UHY Hacker Young, the national accountancy group.

In Exeter, there were 14 cases of disclosures of tax avoidance per 100,000 population. The highest number of disclosures were in Slough (47), closely followed by London (39). The UK average was 17.

UHY Hacker Young says the top areas for admitting underpaid tax tend to be wealthy and home to highly paid individuals who work in sectors such as financial services or IT. These individuals are likely to fall into higher income tax brackets and would, therefore, be tempted to keep more of their income or assets offshore.

UHY Hacker Young adds that HMRC’s renewed focus on taxpayers’ offshore interests may have prompted more individuals to come forward over the last year. If a taxpayer comes forward then HMRC is likely to be more lenient when issuing penalties.

HMRC has been ramping up its activities targeting hidden offshore assets of UK taxpayers, with its specialist ‘Offshore, Corporate and Wealthy’ team launching over 820 investigations last year.

Colin Wright, Chairman of UHY Hacker Young group, says “HMRC’s crackdown on taxpayers offshore may be prompting more individuals in Exeter to come in from the cold and make a voluntary disclosure.”

“The growing resources at HMRC’s disposal means there is nowhere to hide for taxpayers with undeclared offshore interests. It, therefore, makes a lot of financial sense to make a disclosure as this can reduce penalties from up to 200% of unpaid tax to less than 100%.”

“HMRC does not discriminate and will come down hard on all taxpayers with undeclared offshore interests – even if an error on a tax return arises from a genuine mistake. It is therefore important that taxpayers keep their affairs up to date.”

“Making a disclosure it almost always the best way to deal with an irregular tax position but it’s important to seek professional advice before doing so in order to get the best possible settlement.”