2020’s Most Affordable & Least Affordable Cities to Buy a house in the UK: What the data shows!

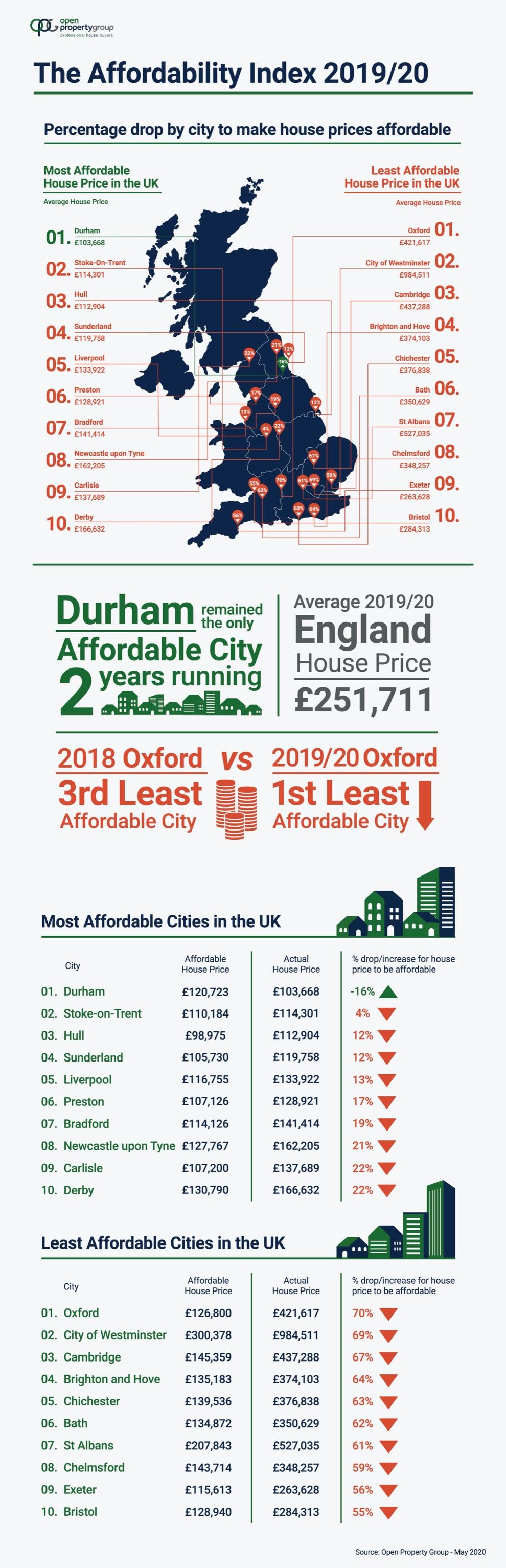

In 2020, property prices in cities across England, Scotland and Wales need to fall by an average of 37 per cent to £125,400 to make owning a home affordable for a single person earning an average wage.

For the second year running, the only place that is affordable for a single person with an average salary for that city and a mortgage of 3.5 times salary is Durham according to research from Open Property Group.

Using average salary and house price data for cities, it can reveal Oxford is the most overpriced place in England where prices would need to fall by 70 per cent for someone with a 20 per cent deposit earning an average wage to afford to buy.

It was closely followed by the City of Westminster, where a drop of 69 per cent would be needed and Cambridge, which would require a drop of 67 per cent.

At the other end of the country house prices in Durham could rise by 16 per cent and still be affordable for someone on an average wage with a 20 per cent deposit and a mortgage of 3.5 times salary.

Open Property Group Managing Director, Jason Harris-Cohen said: “In terms of average house prices, I believe that property prices have already fallen 5% since the COVID-19 outbreak, however we may notice further regional falls depending on micro economic and social issues, as some geographic areas have experienced greater outbreaks of this virus.

For government initiatives, I think that the government should offer a stamp duty holiday to home movers for an initial period.

I would like to see government-backed loans for property buyers to encourage lending and create more liquidity in the market. Lenders are going to be risk averse in the short term and therefore any reluctance to lend will lead to lower mortgage approvals and ultimately less transactions”

The Affordability Index

|

Least affordable with 20 per cent deposit and 3.5 x average salary mortgage

|

|||

|

City |

Affordable house price |

Actual house price |

Percentage drop for house price to be affordable |

|

Oxford |

£126,800 |

£421,617 |

70% |

|

City of Westminster |

£300,378 |

£984,511 |

69% |

|

Cambridge |

£145,359 |

£437,288 |

67% |

|

Brighton and Hove |

£135,183 |

£374,103 |

64% |

|

Chichester |

£139,536 |

£376,838 |

63% |

|

Bath |

£134,872 |

£350,629 |

62% |

|

St Albans |

£207,843 |

£527,035 |

61% |

|

Chelmsford |

£143,714 |

£348,257 |

59% |

|

Exeter |

£115,613 |

£263,628 |

56% |

|

Bristol |

£128,940 |

£284,313 |

55% |

|

Most affordable with 20 per cent deposit and 3.5 x average salary mortgage

|

|||

|

City |

Affordable house price |

Actual house price |

Percentage drop/increase for house price to be affordable |

|

Durham |

£120,723 |

£103,668 |

16% |

|

Stoke-on-Trent |

£110,184 |

£114,301 |

4% |

|

Hull |

£98,975 |

£112,904 |

12% |

|

Sunderland |

£105,730 |

£119,758 |

12% |

|

Liverpool |

£116,755 |

£133,922 |

13% |

|

Preston |

£107,126 |

£128,921 |

17% |

|

Bradford |

£114,126 |

£141,414 |

19% |

|

Newcastle upon Tyne |

£127,767 |

£162,205 |

21% |

|

Carlisle |

£107,200 |

£137,689 |

22% |

|

Derby |

£130,790 |

£166,632 |

22% |

Sources: ONS House Price Index December 2019 and 2020 ONS Labour market statistics for England, Scotland and Wales.

Assumptions – data for 49 cities was available and affordability is based on a single buyer with a lifestyle that would enable borrowing of 3.5 average salary by city. To calculate the affordability by city we have multiplied the average salary for that city by 3.5 times to get 80 per cent of the affordable price then added a deposit of 20 per cent to get the affordable house price.

For more information please visit www.openpropertygroup.com