Renovation Nation: UK homeowners spend £55bn on renovations during lockdown to create their perfect property

With most of the nation stuck indoors due to lockdown restrictions, homeowners across the UK are investing in lockdown makeovers, new research reveals.

The 2020 Renovation Nation Report, by mortgage comparison site money.co.uk, has found that UK’s homeowners have invested an average of £4,035.70 each on home renovations, since the lockdown began in March. And it seems that Brits are sacrificing more than ever for their perfect pad as the prospect of more time at home becomes the new normal.

Garden upgrades (34%) top a list for the most popular lockdown renovation projects, closely followed by the living room (23%), bedroom (22%) and kitchen (22%) as together the nation’s homeowners invested £55bn* in their properties. The findings by the personal finance experts at money.co.uk, also suggest that homeowners have abandoned all hopes of a holiday.

Almost a quarter (24%) stated they have used money originally intended for a holiday to finance their new home improvements, which is second only to general savings (26%). Some even admitted to sacrificing their ‘big day’ as 4% of Brits revealed they used savings originally intended for a wedding or engagement ring.

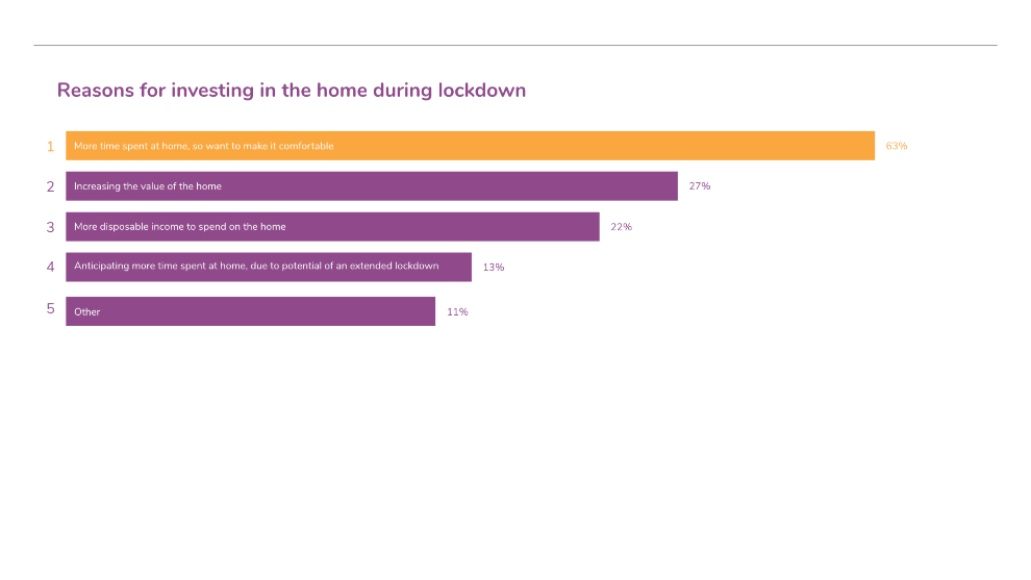

When asked why they chose to invest in their home, over a quarter (27%) of homeowners cited adding value to their home as a reason. Zoom has also played its part. Approaching half (40%) of British homeowners admitted to ‘Zoombarrassement’ over the appearance of their homes.

Keen to make the most of staying home, green-fingered Brits have also been turning their hand to growing their own vegetables, with just over one in five (21%) homeowners investing in a greenhouse or vegetable patch during the pandemic.

Salman Haqqi, personal finance expert at money.co.uk, said: “While many have struggled with the impact of lockdown restriction on their finances, our research found that having to spend more time at home has inspired almost two-thirds (65%) of homeowners to invest in renovations to their properties.

“Almost three quarters (73%) of the property owners we spoke to said they will continue to stay home as much as possible even with lockdown easing, it looks like the trend for investing in homes looks set to continue.

“For those looking to renovate or improve their homes, they will need to balance short term wishes with long term gain. The financial impact of investing in your home should always be a concern and ensuring you add value to your home through the work you do to the property is essential.”

Pandemic changing Brits renovation dreams - but will they add value?

When asked which home project Brits would consider investing in as a direct result of the pandemic, garden projects again reigned supreme:

● Over a third (34%) said they wanted a garden summerhouse/studio

● Over fifth (21%) are craving a greenhouse/vegetable patch

● 14% dream of raising their glass to their own pub.

Inside the home, work and leisure are on the wish list:

● indoor gyms (17%) and bike storage (9%)

● offices (16%)

● leisure rooms (17%)

● and even classrooms (2%) making the list.

Property expert, Adam Parson, Area Supervisor (SE) Andrews Property Group commented: “During these unprecedented times what has become immediately noticeable is the lack of attention people had previously given to the most social areas of the home i.e. garden and living room.

“As we emerge from lockdown the perception of importance has changed, and the specialist areas will be seen as an asset rather than a novelty. Areas such as a garden studio, leisure area or pub/bar area that add a point of difference, escapism or an improvement to well-being will be seen as a necessity. Going forwards, we believe that the home buyers in today’s market will take more notice of these areas which increases their potential to add value to the overall property.”

For more information on what post pandemic renovations will add value to your home and ways to finance them can be found in the 2020 Renovation Nation report at money.co.uk.