Public believe Cameron can't budget

The majority of people living on the breadline think David Cameron has no idea what its like to live on their weekly budget.

People from Exeter took part in a national survey organised by PayPlan, one of the country’s largest free debt management solution providers ahead of this week's general election.

The survey has revealed that 64 per cent have little confidence in the current Prime Minister being able to cope in their financial situation. Conversely, the general public also believes Ed Miliband and Nigel Farage would find it easiest to live on a lower income.

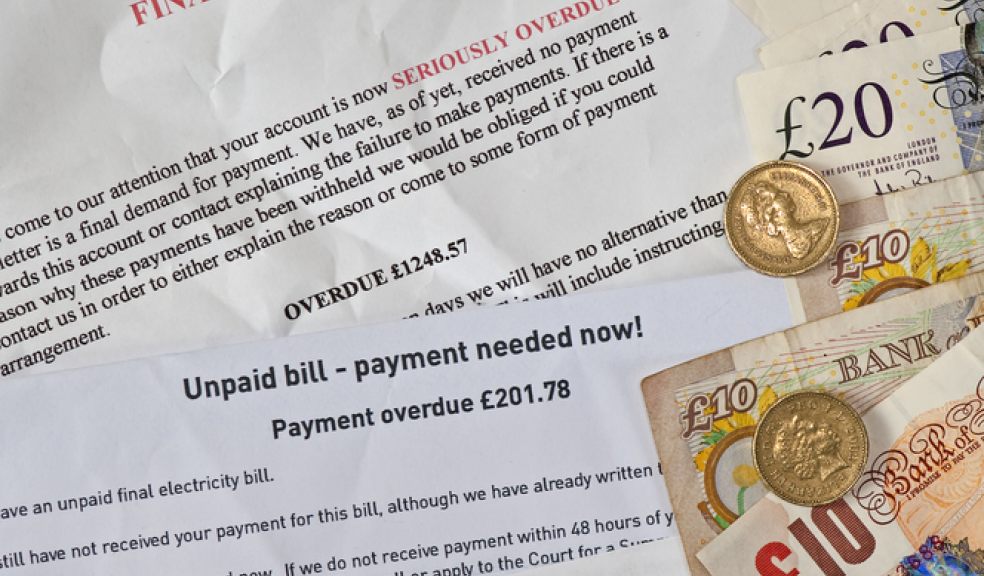

In Exeter, the average debt of people who approach PayPlan for help is £18,996. There are approximately 8.8 million people in serious debt across the UK, amounting to a significant proportion of the electorate.

Further results of the survey include:

• 40 per cent of respondents believe Labour is best placed to improve their personal finances, as opposed to the lowest scoring parties, Lib Dem and the SNP at 4 per cent each.

• Based on this, if the general election was today, 34 per cent of people in debt would vote for Labour, followed by Conservatives at 25 per cent and UKIP at 17 per cent. Lib Dems amount for just 3 per cent of the vote.

• 20 per cent of respondents would vote for a political party they didn’t agree with, if they seemed to give better personal finance promises.

• 79 per cent think national UK debt is more of a priority for politicians than personal debt, and 72 per cent think the Eurozone crisis is talked about more too.

• 64 per cent of people in debt believe it is the responsibility of politicians to help people with personal debt.

“Even though political consciousness is naturally heightened around an election, people are still trying to relate their own situations to the politicians,” explains Jane Clack, money advisor at PayPlan.

A former customer herself, Jane approached PayPlan in 2001 after her business collapsed. Today, Jane is able to use her experiences to advise other people in similar financial troubles as one of the firm’s most trusted money advisors.

She added: “There are almost 9 million people in the UK with serious financial problems in the UK, and the reality is that personal debt can rip families apart, lose businesses millions of pounds due to stress-induced sick days, and be a constant struggle for a huge proportion of the population.

“There is help out there, but it’s clear that the vast majority of people want it to be a talking point which is much higher up on the political agenda.”

For more information about PayPlan’s free debt management solutions, call 0207 760 8976 or visit www.payplan.com