Residents encouraged to ‘spot scams to stop scams’

Devon & Somerset Trading Standards is warning residents to be on the look out for scams.

With the Trading Standards Institute’s ‘Scam Awareness Month’ already underway, local people are being advised on how to avoid falling victim to professional scams that could end up leaving them thousands of pounds out of pocket.

Every year in the South West, hundreds of people are conned by scammers and since May 2012 the total number of complaints made to the team, which is part of a joint service commissioned by Devon County Council and Somerset County Council, have risen by around 10%.

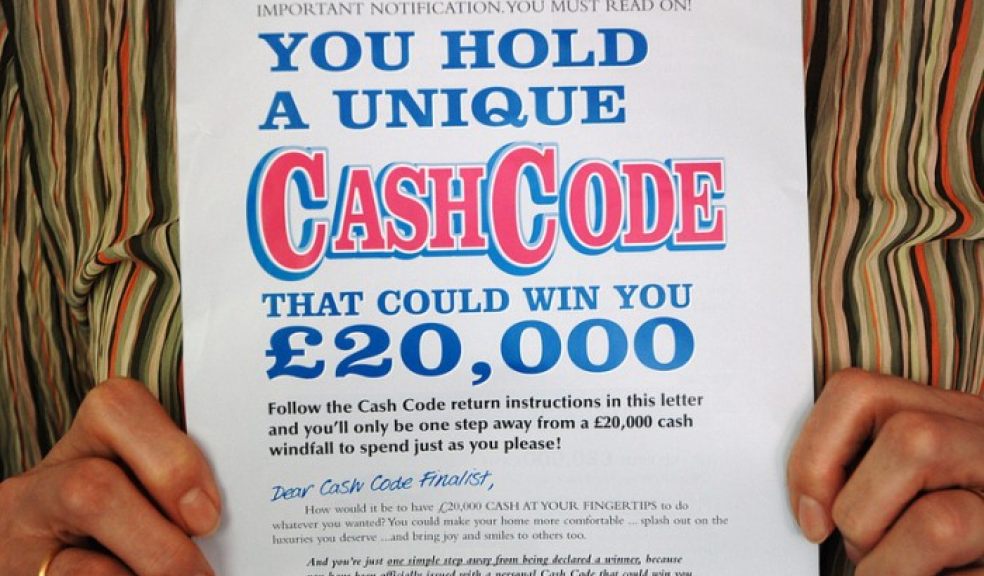

It is estimated that UK consumers lose up to £3.5 billion per year to a variety of scams which exploit low-cost, mass-marketing techniques to target recipients. These include bogus prize draws, premium-rate prize promotions and miracle health cures which mislead recipients.

The number of different types of scams is huge - from psychic frauds to phantom debts, scammers will move on from one scheme to another with the same basic aim, to deprive people of their hard earned cash.

Those most commonly complained about scams in Devon include those offering legal services, lotteries and prize draws and advertising agencies. Complaints about payment protection services have risen sharply this year along with those relating to business guides.

Last year the majority of complaints received were in relation to computer help lines, but following work by the Council’s trading standards team to raise awareness of these scams incidents have more than halved this year.

Peter Greene, Operations Manager for Devon and Somerset Trading Standards Service, said:

“The amount of money residents are loosing to scammers operating in Devon seems to be rising, and we are seeing more and more people fall victim to con artists who promise the world and deliver nothing.

“If you are approached and offered something put of the blue that seems to good to be true, just take a couple of minutes to check for tell tale signs of a scam - such as being asked to send money in advance, saying you have to respond quickly or being asked to keep it a secret.

“Our advice is to never give out your personal details or financial information, and resist the pressure to make a decision straight away. If in doubt don’t reply, just bin it, delete it, walk away or hang up!

“Scams are crimes, so it is vital that people report them, and we would encourage anyone who thinks they may have fallen victim to a scam and lost money or those who have received what they suspect is a scam, to come forward.

“Rest assured that we will continue to take action to protect local people from scams, and make this region a difficult place for scammers to operate in.”

New national figures reveal over 22,000 reports of scams were made to the Citizens Advice Service in England and Wales in the last 12 months. However, these figures are just an indication of the actual amount as many victims fail to report that they have been ripped off because they are too embarrassed.

The month long ‘Scam Awareness’ campaign, which is being led by the Trading Standards Institute and Citizens Advice Bureaux, is warning people to be ever-vigilant against rouges, and urges people to ‘spot scams to stop scams’. They are reminding people that scams come in all shapes and sizes including adverts, people knocking on your door, emails, letters, phone calls, texts and over the internet. Residents are being warned to look out for the key signs that something is a scam, like being contacted out of the blue, requests for money in advance, or telling you to keep it a secret, and are being given some new top tips on how to spot a scam and protect themselves.

What to do if you have been scammed:

- Report it to Action Fraud on 0300 123 2040 to help stop it happening to others.

- Often you can't always get your money back if you've been scammed, especially if you've handed over cash.

- If you've paid for goods or services by credit card you have more protection and if you used a debit card you may be able to ask your bank for a chargeback.

- Get advice and report it to Trading Standards through the Citizens Advice consumer service on 08454 04 05 06 (for advice in Welsh phone 08454 04 05 05) or online advice at www.adviceguide.org.uk

Signs of a scam:

- The call, letter, e-mail or text has come out of the blue.

- You’ve never heard of the lottery or competition they are talking about .

- You didn’t buy a ticket – so can’t win.

- They are asking you to send money in advance.

- They are saying you have to respond quickly, so you don’t get time to think about it or ask family and friends before you decide.

- They are telling you to keep it a secret.

- They seem to be offering you something for nothing.

- If it seems too good to be true – it probably is.

- How to protect yourself better

- Never give out contact details like your name, phone number or address to strangers or to people who should have this information already.

- Never give financial information or details of your identity, bank accounts or credit card to strangers or to the businesses that should already hold your details.

- Shred anything with your personal or bank details on – don’t just throw it away.

- If in doubt, don’t reply. Bin it, delete it or hang up.

- Persuasive sales patter? Just say: “No Thank You.”

- Resist pressure to make a decision straight away.

- Never send money to someone you don’t know.

- Walk away from job adverts that ask for money in advance.

- Ask friends, neighbours or family about whether an offer is likely to be a scam.